Since the first time when India implemented its Goods and Service Tax regime, it was clear that there would be tectonic shift in how Indian enterprises manage tax compliance. Today, millions of invoices are processed each month with a mandate for enterprises to comply with frequent regulatory updates. Businesses that use large-scale ERP platforms like SAP are at an advantage to fully comply with India’s GST regulations owing to SAP’s automation capabilities, reliability and scalability.

Businesses need systems that work well with their ERP environments as compliance frameworks change. Here, SAP-certified GST Suvidha Providers (GSPs) add value by facilitating safe, effective, and instantaneous connectivity between business systems with SAP ERP and the GST Network (GSTN).

Understanding ERP and GST Integration

ERP systems connect the different functions of a business, including finance, procurement, and operations, within one digital framework. They form the backbone of how data moves across an enterprise. GST compliance, however, introduces additional requirements. Filing returns, reconciling transactions, generating E-Invoices, and managing E-Way bills all require a steady and secure exchange of data with the GSTN.

A GST Suvidha Provider bridges this connection. It links your ERP system to the GSTN through approved APIs, allowing data to flow automatically and ensuring accuracy in every submission. For companies using SAP, working with a certified GSP means the entire setup follows SAP’s strict guidelines for performance, reliability, and integration.

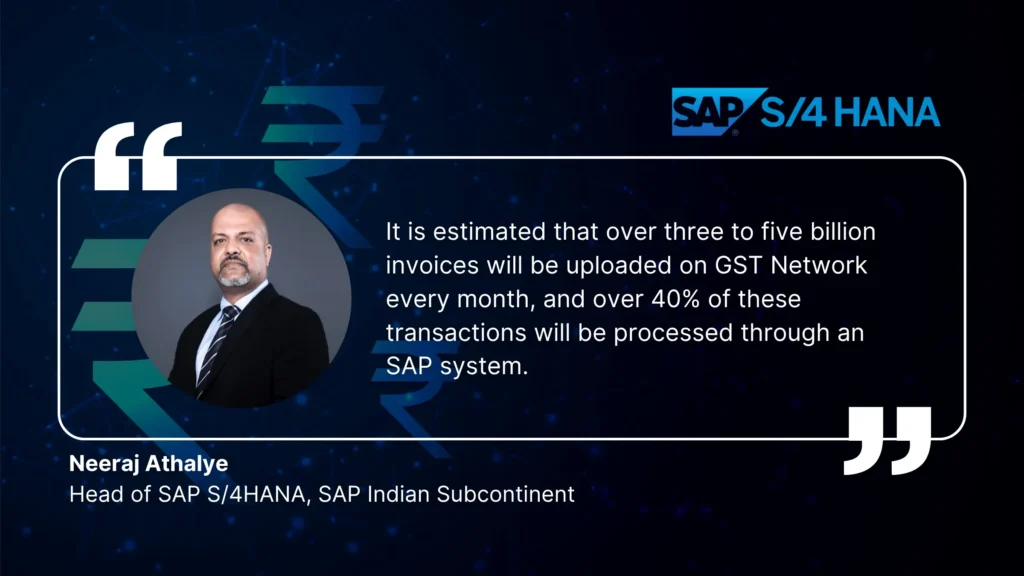

When GST was introduced, it was predicted that –

This projection highlighted how deeply SAP environments are embedded in India’s enterprise ecosystem and why SAP certification for GSPs remains vital for smooth, all scale compliance.

10 Benefits of SAP-Certified GSP Solution for Enterprises

1. Data Security and Reliability

Certified GSPs follow strict security standards set by both SAP and GSTN. They use advanced encryption and access control to ensure data remains secure and accurate at every stage. Since the data is never stored the enterprises maintain complete control and ownership of their information, ensuring full compliance with internal and regulatory standards.

2. Accurate and Timely Filings

With API-based automation, data moves directly from your ERP(1) to the GSTN and vice-versa. This removes the need for manual uploads and format checks, ensuring your returns are filed correctly and on time.

3. Plug-and-Play Integration

Eliminates the need for complex development or maintenance efforts, making integration straightforward and hassle-free for enterprises.

4. System Compatibility

Certified GSPs are built to work smoothly with SAP systems. Even when there are version changes or API updates, compliance operations continue without disruption.

5. Operational Efficiency

Automation reduces repetitive tasks so your finance teams can focus on analysis and governance. This leads to faster processing and fewer human errors.

6. Scalability and Performance

These systems can manage large transaction volumes and are tested for stability under heavy workloads. They are well suited for enterprises operating in multiple regions.

7. Audit and Traceability

Every request is recorded, creating a complete audit trail for internal and external reviews. This transparency builds trust and strengthens compliance confidence.

8. Regulatory Confidence

SAP certification assures that the GSP follows tested protocols and is aligned with both SAP and GSTN compliance frameworks. Enterprises can be confident that filings, e-invoices, and e-way bills are processed without technical disruptions.

9. Interoperability Assurance

The certification guarantees that the GSP works seamlessly with SAP environments (ECC, S/4HANA), allowing organizations to scale compliance without integration disruptions.

10. Regulatory Agility

Since SAP-certified GSPs are required to maintain compatibility with evolving GSTN and SAP updates, enterprises stay future-ready without frequent custom reconfigurations.

For enterprises, these capabilities directly translate into smooth automation reduced compliance risk, improved governance, and higher operational predictability.

Excellon EXACT: SAP-Certified GSP API Solution for Seamless GST Compliance

Excellon EXACT is an SAP-certified, GSP API solution designed for enterprises that prioritize security, and operational transparency. It connects SAP systems directly to GSTN, automating GST compliance in India while keeping complete data ownership within the enterprise environment.

Key Capabilities

Real-time E-Invoice and E-Way Bill Generation

Enables instant E -Invoicing and E-Way bill creation, validation, and submission to GSTN, reducing turnaround time and improving accuracy.

Automated GST Return Filing

Supports end-to-end API-based GST filing for GSTR-1, GSTR-3B, GSTR-9, and other returns, eliminating manual intervention and file uploads.

Compatibility Across Systems

Works seamlessly with SAP ECC, S/4HANA, and even non-SAP ERP systems, while supporting GST Filing, E-Invoicing, and E-Way Bill processes.

Capability for High Transaction Volumes

Designed with multi-cloud redundancy and a scalable framework that accommodates millions of transactions with consistent throughput.

Secure and Clear Data Transmission

Employs a genuine API pass-through model where data is not retained, guaranteeing adherence to enterprise data protection standards.

Reliability and Monitoring

Offers 99.7+% uptime, comprehensive API audit logs, and real-time system monitoring for operational confidence. With EXACT, enterprises gain a robust compliance infrastructure that ensures reliability, accuracy, and consistency across all GST-related workflows while aligning with SAP’s integration standards.

24*7 Support

Expert assistance via email and voice to ensure seamless business continuity.

Conclusion

Tax compliance today isn’t just about following rules, it’s about staying agile in a digital-first world. For organizations working on SAP, partnering with a certified GSP like Excellon EXACT brings that confidence. It keeps compliance secure, reliable, and scalable, backed by the speed and accuracy that modern businesses rely on.

For enterprises still evaluating their options, explore our insights on How to Choose the Best GSP for GST Compliance to make an informed decision.

Contact Us

Understanding India’s GST 2.0 Reforms and Compliance Framework